best way to save your money in gold

buy gold in phonepe

how to buy gold in phonepe ?

what is Gold saving in phonepe application

no need to open demat account in other application

Introduction to Gold Saving on phone pay

Gold saving has emerged as a vital strategy for wealth accumulation and financial security. Traditionally viewed as a tangible asset, gold has maintained its value across centuries, making it a preferred choice for safeguarding wealth. With the advent of technology, particularly through financial platforms like PhonePe, the process of gold saving has been revolutionized, allowing individuals to invest in gold with unprecedented ease and accessibility.

The concept of digital gold refers to the ability to buy, sell, and store gold online in a secure manner. Unlike physical gold, which necessitates storage and protection, digital gold enables users to own gold virtually, thus eliminating common concerns associated with maintaining physical assets. Through services provided by platforms like PhonePe, users can partake in gold saving without the complications of traditional methods. This modern approach not only democratizes access to gold investments but also empowers individuals to integrate gold saving into their broader financial strategies.

Investing in gold through digital platforms aligns well with the current preferences of tech-savvy consumers who seek convenience and flexibility. With PhonePe, customers can perform transactions at any time and from any location, allowing them to make informed investment decisions based on market conditions. Moreover, the option to invest small amounts facilitates gold saving for a wider demographic, breaking barriers to entry that previously existed with brick-and-mortar buying methods.

As a result, gold saving through digital channels is not just a feasible option but a strategic choice for anyone looking to enhance their financial portfolio. By leveraging technology for gold investment, individuals can enjoy the benefits of gold’s historical stability while engaging in a contemporary financial ecosystem that caters to modern needs.

What is PhonePe and How Does It Work?

Safety ghode se piece best way to save your money in phonepe you can buy gold today you can sell your Gold easily many people trusted these app and buy gold.

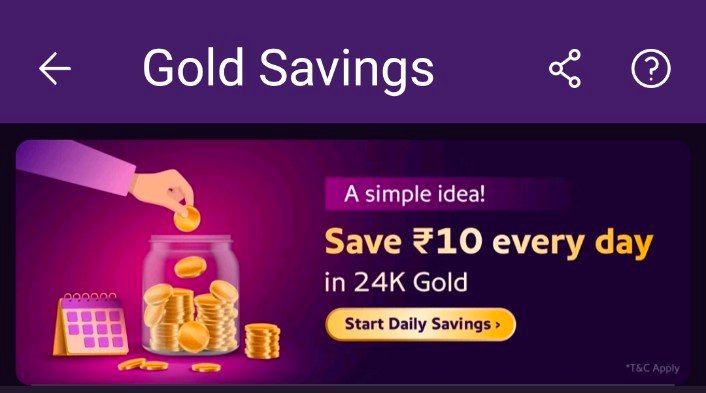

you can go phonepe application and add accounts and go to purchase his saving and more options you can choose save daily gold. Daily Gold saving SIP is the best way to improve your Gold.

PhonePe is a prominent digital payments platform that has gained widespread popularity in India since its inception. Launched in 2015, this application allows users to carry out a variety of financial transactions, including payments, money transfers, and service bill payments. It operates on the Unified Payments Interface (UPI), a system that facilitates real-time bank-to-bank transactions through smartphones.

One of the primary features of PhonePe is its ability to link multiple bank accounts under a single application. Users can seamlessly switch between accounts when making payments, enhancing convenience. Additionally, PhonePe supports various payment methods such as credit and debit cards, as well as wallets. This versatility caters to a broad range of user preferences, ensuring that financial transactions are straightforward and efficient.

Another significant aspect of PhonePe is its diverse array of features, which extend beyond standard payments. Users can access services such as insurance purchases, recharges, investments in mutual funds, and even savings options, including the ability to save in gold. This integration of financial services into a single platform makes it easier for users to manage their finances effectively.

Gold saving on PhonePe is particularly noteworthy. This feature allows users to invest in gold digitally, making it an attractive option for individuals looking to accumulate wealth over time without the hassles associated with physical gold ownership. The process is user-friendly, with the app providing a simple interface for users to purchase, store, or redeem gold as needed. Overall, PhonePe stands out as a comprehensive financial hub that prioritizes user accessibility and functionality, ensuring a smooth experience in the digital financial landscape.

Understanding Digital Gold

Digital gold refers to a modern investment method that allows individuals to invest in gold virtually, without needing to physically hold the metal. This innovative approach to gold investing has gained popularity in recent years, fueled by advancements in technology and a growing interest in financial security. One of the primary advantages of digital gold over traditional gold investments is its accessibility. Investors can purchase gold fractions at competitive prices, allowing for greater flexibility and lower entry barriers for new investors. In contrast to conventional gold purchases, which often require substantial funds for physical ownership, digital gold can be acquired in small amounts, making it an appealing option for a wider range of individuals.

The process of purchasing digital gold is straightforward. Investors can use platforms such as PhonePe to buy gold online using the app. The amount purchased is stored in a secure digital vault managed by accredited service providers, ensuring transparency and trust. Users can initiate purchases with a few taps on their smartphones, eliminating the need for lengthy transactions typically associated with physical gold purchases. Additionally, selling or redeeming digital gold is equally effortless, as users can instantly sell their holdings through the same platform, receiving the proceeds directly in their linked bank accounts.

Safety and security are paramount concerns when it comes to any investment, especially those involving precious metals. Digital gold operates under strict regulations and is typically backed by physical gold held in secure vaults. Reputable service providers maintain high standards of security, including insurance for the gold assets and robust encryption for online transactions. This level of protection affords investors peace of mind, knowing their assets are secure. Overall, digital gold presents an innovative alternative to traditional gold investing, blending convenience, accessibility, and safety to meet the needs of modern investors.

Step-by-Step Guide to Gold Saving on PhonePe

To begin your journey of gold saving on PhonePe, it is essential to set up your account. First, download the PhonePe application from the Google Play Store or Apple App Store, depending on your device. After installation, open the app and register by entering your mobile number and verifying it with an OTP (One Time Password) sent to your phone. If you already have an account, simply log in using your credentials.

Once logged in, the next step is funding your account. Navigate to the ‘Wallet’ section within the app. Here, you can link your bank account or credit/debit card to deposit funds securely. Select the amount you wish to load into your PhonePe wallet. Ensure that the balance is sufficient for your intended gold purchase.

After successfully adding funds to your wallet, it is time to explore the gold options available on PhonePe. Go to the ‘Gold’ section, which provides a range of gold investment plans tailored to suit different needs. You can select from options like buying gold for saving purposes or investing in gold as an asset. Review the purities and prices displayed before making a selection.

When you have chosen your gold savings option, proceed to complete your transaction. Enter the amount of gold you want to purchase, and the total price will be calculated based on the current market rates. Ensure to review all details before confirming your transaction. Finally, after successfully completing the purchase, you will receive a confirmation notification, and the gold will be securely stored in your PhonePe account, easily accessible at any time.

This step-by-step guide ensures that you can effectively start saving gold using PhonePe, providing a simple and intuitive process from account setup to making transactions.

Benefits of Saving Gold on PhonePe

Saving gold on PhonePe offers numerous advantages that appeal to a wide range of users, from seasoned investors to casual savers. One of the primary benefits is liquidity. Digital gold, as facilitated by PhonePe, allows users to convert their gold holdings into cash easily, providing immediate access to funds when needed. This is especially advantageous in times of financial emergencies when quick liquidity is a priority.

Another significant benefit of saving gold on PhonePe is the unparalleled convenience it affords. Users can buy, sell, or manage their gold assets directly through the PhonePe application, eliminating the need for physical storage or complicated processes associated with traditional gold investment. This user-friendly approach enables individuals to participate in gold saving without any hassle, affording them the freedom to track their investments seamlessly. Whether you are making a small investment or a more substantial purchase, the digital platform allows for automatic transactions and instant notifications, which enhance the user experience and keep savers informed.

Security is a critical concern for investors, and saving gold on PhonePe addresses this adequately. The platform ensures that the digital gold is secured through reputable custodians, providing an additional layer of trust. This security assurance is essential for individuals who may be hesitant to invest in physical gold due to concerns about theft or loss.

Lastly, saving small amounts of gold through PhonePe allows users to start their investment journey without needing significant capital. This accessibility encourages individuals to diversify their portfolios methodically. Furthermore, with the potential for financial growth, users can leverage their digital gold as part of a broader investment strategy, which may include trading or leveraging rising gold prices to enhance their net worth over time.

Comparing Digital Gold with Traditional Gold Investments

When considering gold investments, individuals have two primary options: traditional gold, such as bullion and jewelry, and digital gold offered through platforms like PhonePe. Each option presents unique advantages and disadvantages that potential investors should carefully evaluate.

Traditional gold investments involve purchasing physical forms of gold, such as coins, bars, or jewelry. One significant advantage of traditional gold is its tangibility; investors can physically possess their asset, which can provide a sense of security. Additionally, physical gold often holds aesthetic value, especially in the case of jewelry, allowing for dual utility as both an investment and an elegant accessory. However, issues such as storage, insurance, and concerns over purity can complicate traditional gold ownership. Investors must also be cautious about market fluctuations and liquidity, as selling physical gold often involves added transactional costs.

On the other hand, digital gold introduces a modern, technology-driven method of investing in gold. Services like PhonePe allow users to buy, store, and sell gold electronically, providing numerous benefits. One of the primary advantages of digital gold is convenience; it eliminates the need for storage as the gold is held in secured vaults by reputable providers. Additionally, investors can start with smaller amounts, making it more accessible to a broader audience. Digital gold transactions are generally seamless, often enabling investments at just the tap of a button. However, the lack of physical possession may deter some investors who prefer having tangible assets. Moreover, the reliability of the digital gold provider is crucial, as investors must trust that the gold they purchase is accurately represented and secure.

In essence, both traditional gold investments and digital gold have their strengths and weaknesses. Traditional gold offers tangible assets with aesthetic appeal, while digital gold provides convenience and accessibility. Therefore, the choice between the two often depends on the investor’s personal preferences, risk tolerance, and investment goals.

Safety and Security Measures in Gold Saving

In today’s digital age, assuring the safety and security of financial transactions is paramount, especially when investing in assets like digital gold. PhonePe has established several protocols and measures designed to protect user investments in gold saving, providing users with peace of mind throughout their investment journey. One of the most significant aspects of these security measures is the provision of insurance for the digital gold purchased through the platform. By ensuring that users’ investments are safeguarded against unforeseen events, PhonePe instills confidence in its customers while enhancing the robustness of its service.

Moreover, PhonePe utilizes secure storage facilities to store the digital gold purchased by its users. These state-of-the-art storage solutions ensure that the gold is adequately protected from physical threats, such as theft or damage. The stored gold is often subject to audits and regular checks, reinforcing the commitment of PhonePe to maintaining transparency and trust. The implications of secure storage are significant, as users are assured that their investments are not only protected but also readily available when required.

User privacy is another critical parameter in PhonePe’s safety and security protocols. Through stringent data encryption techniques, the platform safeguards user information, preventing unauthorized access and ensuring a secure transaction environment. This level of privacy is crucial, as it protects sensitive financial data from potential breaches or cyber threats, further enhancing the overall user experience. With these comprehensive safety and security measures in place, PhonePe demonstrates its commitment to protecting user investments while fostering a secure atmosphere for digital transactions. In conclusion, the combination of insurance options, secure storage, and strict privacy controls underscores the significance of user safety in the realm of gold saving on PhonePe.

Common Misconceptions about Digital Gold

Digital gold investment is gaining traction among consumers, yet several misconceptions continue to circulate, often leading to confusion. One prevalent myth is that owning digital gold is equivalent to possessing physical gold. While both forms represent an investment in the same asset, they differ significantly in terms of ownership and storage. When an individual purchases digital gold, they acquire a proportionate ownership of gold that is securely stored in a vault, rather than receiving tangible gold coins or bars. This distinction is crucial, as it reassures investors about the credibility of the digital gold platform, like PhonePe, which guarantees the purity and quality of the gold in its reserves.

Another common misunderstanding pertains to the liquidity of digital gold. Many potential investors believe that accessing their investment will be complicated. In reality, digital gold offers high liquidity. Investors can buy and sell their holdings seamlessly through platforms like PhonePe at competitive market rates. This feature provides a significant advantage over traditional gold investments, which typically involve higher transaction costs and logistical challenges associated with the physical transfer of gold.

Additionally, concerns about security and the integrity of digital gold are prevalent. Some individuals doubt whether the investment is genuinely safe. However, reputable digital gold platforms implement strict security protocols, including encryption and insurance, ensuring the safekeeping of investor assets. The ease of monitoring one’s digital gold holdings through a mobile application further enhances transparency and trust in the investment.

By addressing these misconceptions, potential investors can have a more informed perspective on digital gold. Understanding the differences in ownership, liquidity, and security can empower individuals to make educated decisions about their investments in digital gold while utilizing technological advancements offered by platforms like PhonePe.

Conclusion: The Future of Gold Saving with PhonePe

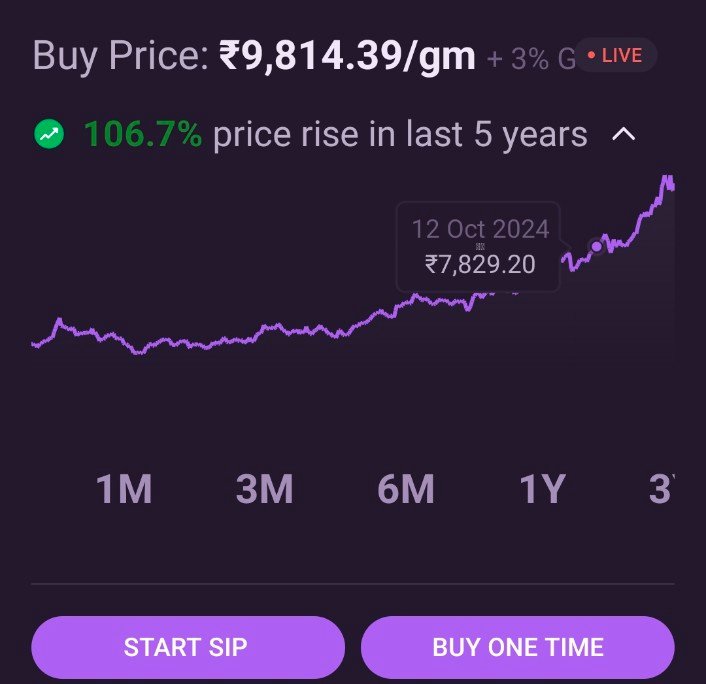

The landscape of investment is rapidly evolving, with mobile applications like PhonePe leading the way in making gold saving accessible to the masses. Digital gold investment represents a significant shift from traditional methods, offering convenience and flexibility. The integration of gold saving options within such platforms not only democratizes access to asset management but also paves the way for innovative financial solutions that cater to a diverse audience.

The future of gold savings with PhonePe looks promising, as it aligns perfectly with the growing trend toward digitization in finance. More users are recognizing the benefits of buying gold digitally, including instant transactions, lower fees, and the ability to track investments in real time. Given these advantages, it is likely that this trend will continue to gain momentum, attracting both seasoned investors and newcomers alike.

Moreover, as technology advances, we may witness new features being introduced that enhance user experience and investment strategies. Such innovations could include personalized portfolio management tools, educational resources on gold investment, and loyalty programs rewarding frequent savers. By embracing a digital approach to gold saving, PhonePe is not only making investments more accessible but also transforming how individuals perceive and engage with gold as an asset.

As you consider your investment options, it is essential to stay informed about the evolving landscape of digital gold savings. Platforms like PhonePe are at the forefront of this financial evolution, and potential developments in this space could significantly benefit savvy investors. Embrace the opportunity to diversify your portfolio with gold saving on PhonePe, and keep an eye out for upcoming improvements that could enhance your investment experience.

Introduction to Gold Saving

With the rise of digital platforms, traditional saving methods are being complemented by modern technology. One such innovation is gold saving through Phone Pe, a service that offers numerous advantages for users. Understanding these benefits is essential for making informed financial decisions.

Security and Convenience

Gold saving on Phone Pe provides a secure platform for storing and investing in gold. Unlike physical gold, which may be vulnerable to theft or loss, your digital gold is safeguarded within the app. This eliminates concerns over security and maintenance, allowing users to enjoy convenient access to their investments at any time with just a few taps on their mobile devices.

Affordability and Flexibility

Investing in gold has traditionally required a significant financial commitment. However, Phone Pe has made it possible to purchase gold in smaller quantities, making it more accessible for everyone. This flexibility allows users to start saving with minimal amounts, aligning with their financial capabilities. Additionally, the platform often provides enticing offers and low transaction fees that further enhance the appeal of gold savings.

Wealth Protection and Growth

Gold has been regarded as a safe haven during economic uncertainty. By saving gold through Phone Pe, users are not only protecting their wealth but also potentially benefiting from the appreciation of gold prices over time. This dual advantage makes digital gold saving a strategic choice in establishing a diversified investment portfolio.

Understanding Gold Saving Images

Gold saving images are captivating visual representations that symbolize wealth and prosperity. These images not only evoke a sense of luxury but also serve as a powerful medium for investment-oriented discussions. The allure of gold has been consistent throughout history, and the imagery surrounding it plays a critical role in influencing public perception and individual investment decisions.

The Role of Visual Representation in Investment

In the realm of finance and investment, the impact of visual aids, such as gold saving images, cannot be overstated. These images allow potential investors to visualize their goals and the benefits of investing in gold. By employing rich, alluring imagery, sellers can create an emotional connection with their audience, ultimately guiding them toward making informed investment choices. The right images tell a story, offering viewers a glimpse into the value and security that gold can provide.

Curating a Collection of Gold Saving Images

For those interested in gold investing, curating an appealing collection of gold saving images is essential. Such a collection can be used for personal motivation or as a visual tool for presentations aimed at educating others about the merits of gold investment. Platforms like Pinterest and Instagram provide fertile ground for discovering unique and aesthetically pleasing gold imagery, which can inspire and inform potential investors. By focusing on high-quality visuals, individuals can enhance their understanding and appreciation of the investment potential associated with gold.